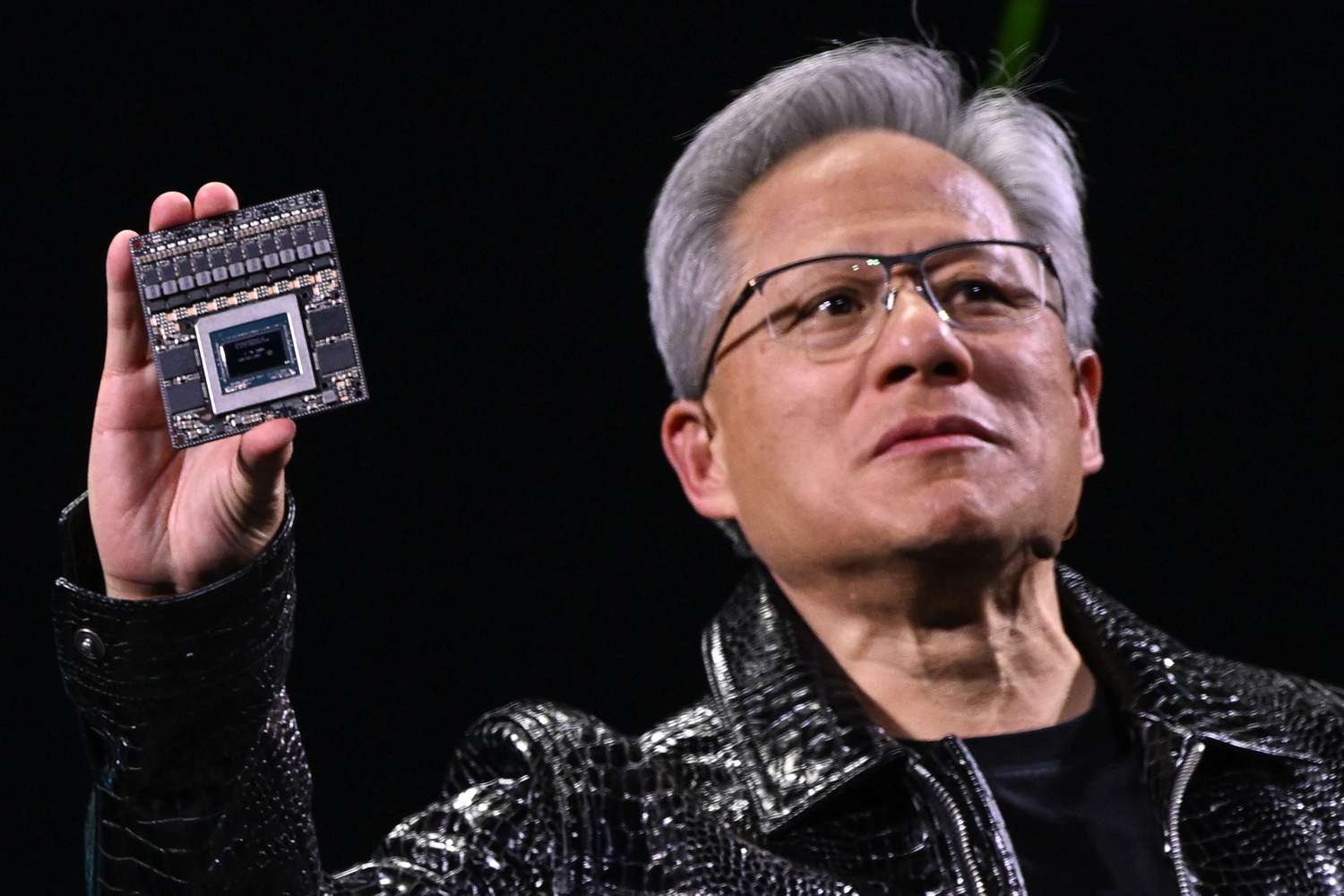

NVIDIA Stock: The Future of AI Investment. What’s Next?

NVIDIA Corporation (NVDA) has been a prominent player in the AI industry, known for its high-performance GPUs that power various AI applications. Recently, the company faced a significant market challenge due to the emergence of Deep Seek, a Chinese AI start up that developed a cost-effective AI model. This development led to a substantial decline in NVIDIA’s stock value, with a loss of nearly $600 billion in market capitalization—the largest one-day loss in U.S. history

Despite this setback, NVIDIA’s stock has shown resilience. After the initial plunge, the stock rebounded by approximately 8.9%, closing at $128.99. As of the latest data, NVIDIA’s stock is trading at $118.65, reflecting a slight increase of 1.88% from the previous close.

Analysts remain optimistic about NVIDIA’s future in the AI sector. The company’s strong fundamentals and history of innovation position it well to navigate current challenges. Some experts view the recent market dip as a potential buying opportunity, suggesting that NVIDIA’s valuation remains reasonable compared to other tech giants.

However, the rise of competitors like DeepSeek underscores the dynamic nature of the AI industry. Investors should monitor how NVIDIA adapts to these developments and continues to innovate in response to emerging competition.